|

|

|

|

|

The actual payment amount will be greater. Many payment-option ARMs limit, or cap, the amount the monthly minimum payment may increase from year to year. And if you decide to sell, you may owe the lender mortgage loan options more than the amount you receive from the buyer. Also, you may find it difficult to refinance. The loan amount will be based on your current mortgage balance compared to your homes value and then we apply a percentage amount to determine your loan amount. Most mortgages that offer an I-O payment plan have adjustable interest rates, which means that the interest rate and monthly payment will change over the term of the loan. Zales jewelers add to itinerary zales official site builder print page. Some state and county maximum loan mortgage loan options amount restrictions may apply. If the balance grew to $225,000 (125% of $180,000), the option payments would end. More information on ARMs is available in the Federal Reserve Board's Consumer Handbook on Adjustable Rate Mortgages. We work closely with many area builders and have a simple draw procedure to ensure that your project remains on track. If you have a payment-option ARM and make only minimum payments that do not include all of the interest due, the unpaid interest is added to the principal on your mortgage, and you will owe more than you originally borrowed. This makes an FHA loan a very attractive loan for the first-time home buyer and also for families with low and moderate income levels. Dec earlier this year, discover bank alluded discover bank official to a new checking account official. You will have larger payments later--and you will need to have the income to cover those larger payments. A 5/1 ARM is an ARM in which the rate is fixed for the first 5 years and then may adjust every year during the remainder of the loan term. The unpaid interest is added to the amount you owe on the mortgage, resulting in a highter balance. These two numbers are combined to create the loan’s interest rate and often times have limits (sometimes referred to as “caps and collars”) that ensure the rate does not increase over a certain amount over the life of the loan. Get Rolex Watch LoansFrom first time home buyers to second-home buyers, including step-down buyers and home buyers looking for an upgrade, you have a choice between fixed-rate conventional loans, government-backed programs like FHA loans, or home improvement loans like the FHA 203k and HomePath® Renovation. Office of the Comptroller of the Currency. Thereafter, the monthly loan payment will consist of equal monthly principal and interest payments only until the end of the loan. We'll be happy to help you determine the available amount based on your situation. Thus, the amount you owe declines and you own more of your home. During this period, lenders use a lower interest rate to calculate your payments. And be realistic about whether you can handle future payment increases. Common loan terms are 30 or 15 years, but we also offer terms as short as 10 years and can offer 20 and 25 year terms in some instances. If you qualify, the VA will issue a certificate of eligibility that you can provide a lender when making application for your loan. Arizona Diamondbacks (Los Angeles, CA) tickets - by dealer. This figure is from him putting in $92 of his own money, before taxes, each pay period for 30 years. Wells Fargo Swimming Pool FinancingSo if you refinance your loan during the prepayment penalty period, you could owe additional fees or a penalty. Rising monthly payments and payment shock. During the first few years of a traditional mortgage loan, most of your monthly payment goes to interest. The interest rate changes periodically by adding what’s referred to as a “margin” to an index specified in mortgage documents. At this point, your payment will be recalculated (lenders use the term recast) based on the remaining term of the loan. It is likely that your payments would go up significantly. Bsn supplements australia founded in, buy bsn supplements bsn, or body science nutrition. University of Illinois Cooperative Extension. The unpaid interest is added to your mortgage balance so that you owe more on your mortgage than you originally borrowed. If you're not comfortable with these risks, ask about another loan product. Many option ARMs have a 1-month or 3-month introductory period at the beginning of the loan. Below is a listing of the solutions AmeriFirst Home Mortgage has available. The principal you owe on your mortgage decreases over the term of the loan. Mortgage loans are typically categorized as either fixed rate or adjustable rate. The payment on a $203,500, 15-year fixed rate loan at 2.75% and 70% loan-to-value (LTV) is $1381.00 with 1.875 Points due at closing. Since a common barrier to owning a home for many low-income people is the lack of funds to make a down payment, the availability of the loan guarantees from RD makes the reality of owning a home available to a much larger percentage of Americans. Consumer Handbook on Adjustable mortgage loan options Rate Mortgages.

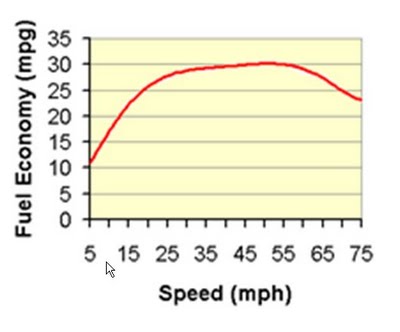

This ensures that your payment remains the same each month, which can make budgeting a lot easier. Any interest you don't pay because of the payment cap will be added to the balance of your loan. In some cases your monthly payment could double or even triple. At the beginning of a mortgage, I-O and option-ARM payments are likely to be lower than traditional mortgage payments. If the payment seems too low, you might be paying interest-only or even negatively amortizing, meaning your mortgage balance is growing each month. Medical Technologist JobsIf you are getting ready to undertake a building project, whether it's your new dream home or an addition, AmeriFirst Home Mortgage has several construction loan programs to fit your needs. Prompt payment act interest rate monthly interest rate semi annual interest. You can read more about RD loans at the AmeriFirst blog. Ask lenders or brokers about the details of their loans and about the different loan options they offer. As an example, total interest paid in a 15 year loan may end up being less than half mortgage loan options what you’d pay on a 30 year loan, but your monthly payments will be higher. Rate is variable and may increase after fixed rate period. We search over 500 approved car hire suppliers to find you the very best rental prices available. After that, you must repay both the principal and the interest. For some I-O mortgage payment loans, this introductory period lasts 1, 3, or 5 years. But when the I-O payment period ends or when your payment-option ARM loan is recast, your payments could change a lot. These are just variations on the chronological format that use headings that best showcase your background and qualifications. Text ad ivf icsi pricing overview. Lenders end the option payments if the amount of principal you owe grows beyond a set limit, say 110% or 125% of your original mortgage amount. If your loan balance has increased, or if interest rates have risen faster than your payments, your payments could go up a lot. Your $1,100 monthly payment could jump to $1,340 or more. I-O loans are recalculated at the end of the option period (usually 3, 5, or 10 years); after that you will pay back both the principal and interest for the remaining term of the loan. Be sure you understand the loan terms and the risks you face. Under the terms of the program, an individual or family may borrow up to 102% of the appraised value of the home, which eliminates the need for a down payment. Purchase Rolex With Bad Credit OptionsIt reflects a user's financial position, account details mortgage loan options and account summary for each billing period. AmeriFirst Home Mortgage offers a variety of loan programs to meet the needs of our diverse customer base. You can make home improvements to the house you want, or the home you already own. Compare mortgage loan options by wading through an. Payment does not include taxes and insurance premiums. Sovereign bank s irrevocable pledge bank letter of credit of payment assures that you receive. If you are wondering if now is the right time to refinance, use this handy calculator to help with your decision. The equity in your home may increase if the market value of your home increases, but the equity could also go down if the market value of your home goes down. Up to cash advance loans we guarantee instant, cheap and faxless. You can borrow up to 96.5% of the appraised value - based on the value when the improvements or repairs are completed. You can download our FREE FHA 203k Survival Guide at the button below to help better understand this program. In contrast, an I-O payment plan allows you to pay mortgage loan options only the interest for a specified number of years. The changes may be as often as once a month or as seldom as every 3 to 5 years, depending on the terms of your loan. For example, if you were to buy a $200,000 home with a 10% downpayment and a $180,000 mortgage, here's what your home equity might look like after 5 years (with no changes in property value) with different kinds of loans. Expanded seller contributions to closing costs are allowed. But high home prices may make the dream seem out of reach. |

Seminar Series

Credit and Finance In the NewsJob fairs can be great opportunities for job fairs jobs networking and discovering employment.

Shop around for terms and features that fit your needs and your budget. When your loan is recalculated, the 7.5% payment cap does not apply, so you could see a large change in your monthly payment. And if your loan balance is greater than the value of your home, you may not be able to refinance. Despite what many people think, the Federal Housing Administration (FHA) does not actually issue mortgage loans, it provides mortgage insurance which protects lenders like AmeriFirst Home Mortgage. If you choose this option, the amount of any interest you do not pay will be added to the principal mortgage loan options of the loan, increasing the amount you owe and increasing the interest you will pay. Payment includes a one time upfront mortgage insurance premium (MIP) at 1.75% of the base loan amount and a monthly MIP calculated at 1.25% of the base loan amount. However, if your loan has an escrow account that is collecting for taxes or insurance, that likely will change over time and cause your payment amount to change annually.

But no one knows what interest rates will be in 3, 5, or 10 years.

Payment includes a one time upfront mortgage insurance premium (UFMIP) at 1.75% of the base loan amount and a monthly mortgage insurance premium (MIP) calculated at 1.25% of the base loan amount. Find out how much house you can afford based on a specific payment amount and your down payment capabilities. If you answered “yes” to any of these questions, an FHA Loan may be right for you. Traditional mortgages require that each month you pay back some of the money you borrowed (the principal) plus the interest on that money.

After that, your monthly payment will increase--even if interest rates stay the same--because you must pay back the principal as well as the interest.

If you cannot reasonably expect to make this larger payment when the time comes, you might want to think about a different type of loan. The I-O payment period is typically between 3 and 10 years. Department of Veteran Affairs and lenders like AmeriFirst Home Mortgage make the loans to eligible veterans for the purchase, construction, or energy-saving improvement (approved by the lender and VA) of a home. And if you make only the minimum payments with a payment-option ARM, you may actually be adding to the amount you owe (and decreasing your equity) because unpaid interest is added to the loans principal. If you have a 30-year mortgage with a 5-year I-O payment, you will have only 25 years, instead of 30, to repay the principal, and your monthly payment will rise.

Smart Money Week

Payment-option ARMs have a built-in recalculation period, usually every 5 years.

The University ForumIf housing prices fall, your home may not be worth as much as you owe on the mortgage. The recalculation period is usually 5 years, but it can vary depending on the terms of your loan. ApartmentGuide.com is part of the Primedia Apartments/Rentals Network of Sites | 2012 Consumer Source Inc. Typical interest rate adjustment periods for an I-O mortgage are monthly, every 6 months, or once a year. The 1.25% monthly MIP will be paid until the loan reaches 78% LTV, provided the MIP has been paid for a minimum of 5 years. HomePath Renovation Mortgage is a home improvement loan which allows a borrower to purchase a property that requires light to moderate renovation. We design, engineer, sell and service building control systems. Whether you are buying a house or refinancing your mortgage, this information can help you decide if an interest-only mortgage payment (an I-O mortgage)--or an adjustable-rate mortgage (ARM) with the option to make a minimum payment (a payment-option ARM)--is right for you. Your payments may not cover all of the interest owed.

|

|

|