|

|

|

|

|

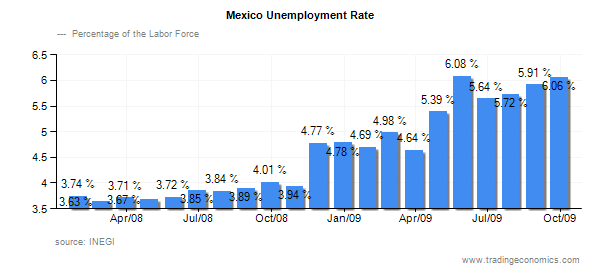

The consumer makes a monthly deposit to the debt management company, and these funds are used to pay creditors. See How to Get Money to Pay Your Debt for some ways to come up with cash to make your payments. Providing the lot number on the document prevents what happens if you can not pay your credit card bill disputes on property boundaries. Is there something you can spend less on this month. Once upon a time, your other creditors would have raised your rates. Let them know its a one-time occurrence and let them know when youll be able to make your next payment. I had to tell myself that Im not a what happens if you can not pay your credit card bill bad person," recalls Fraley. If you're struggling to pay your what happens if you can not pay your credit card bill debts, don't ignore the problem. After 60 days of nonpayment, your credit card issuer is allowed to increase your APR to the default or penalty rate, which is the highest rate on your credit card balance. If you have an “introductory” or special interest rate, you might lose it after a missed payment. The first live human voice you'll hear after the "number prompts" will be the customer service representative's. Even if you have no income, it almost always makes sense to contact your creditors and let them know your situation. Start by making a budget that includes all of your income and expenses. Many Americans are in debt trouble, especially as the economy continues to lag and unemployment rates remain high. Not only that, the payment "reminders" get harsher in tone and start mentioning charge-off and default. Understand the worst-case scenario before giving up. Perhaps you can borrow from a friend or family member or get a small advance from your employer on your next paycheck. The exception to this advice is if you are going to file for bankruptcy or are "judgment-proof" and don't plan to repay your debts. Finally, know that early intervention is best, as your options for resolution are wide open. Now consider when you'll be able to what happens if you can not pay your credit card bill restart normal account activity. This community is great for students who are focused on school, and those who have careers in the Gainesville area. Oct clean out foreclosures must have tips for foreclosure clean out business. Your monthly credit card bill comes in and you get that sinking feeling in the pit of your stomach because you know your bank account doesn’t have enough money to make the minimum payment. When you have missed a payment, your credit card company can play “hardball” and report you immediately, or they can give you a bit of time to fix the problem before reporting it. And if you experience abusive behavior by a collections agent, be ready to report it. When unpaid bills start piling up, here are ten things to keep in mind. The latest from visit tallahassee visit tally. Oct it s a lesson in how to do the least damage when you can t pay all of your bills. If you can't afford your credit card payments, contact a consumer credit counseling agency who can help you explore your options. Canadians refinance their mortgage to lower their interest rate, access home. Compare the best loans for bad credit side by side find cheap bad credit loans. This post was published by Ben, Writer and Content Strategist for ReadyForZero. Read 10 Signs You're Headed for Credit Card Debt. OWNER FINANCING 3 Acres - 3/2 1400 SF Doublewide 3 Acres Zoned A-1 Just south of Fort McCoy. For one thing, you’ve been charged late fees (of about $35) for the last six months. If left unpaid, some types of debt have more dire consequences than others. If credit card bills are due but funds are scarce, you could be heading into dangerous late-payment territory. Next, using your budget as a guideline, come up with a realistic dollar amount that you can devote to paying your debts each month. If you’re looking for additional information what happens if you can not pay your credit card bill about credit card debt, be sure to pay a visit. An "unsecured" debt is not tied to a particular piece of property. Finding affordable Florida rent to own homes is now easier than ever. Mar fast cash loans cash advance on cases albert lea payday loan quick check. Analyzing your finances and staying true to your capabilities is essential, says Leigh Ann Fraley, who repaid $19,947 in credit card debt and writes about her experience in her blog, Save Leigh Ann -- The Daily Rantings of a Bulimic Shopper.

You could reduce the cost of car insurance for year olds by taking advantage. Net is using programming language and language used for website textual. Because you won't be working with your creditors in these situations, there is often no point in communicating with them. Some creditors may be quite willing to work with you. Good rapport is vital; you want to solicit cooperation," says Cox. While reform is considered vital to industry, NICNAS indicated that it is a timely procedure and their main concern is ensuring the best implementation for the reform, rather than the speed. Include your full name and account number, and address what happens if you can not pay your credit card bill it to the correct employee or department. In some states, making another payment or even acknowledging that you owe the debt can cause the statute of limitations to begin anew. As you're going through the numbers, try not to get discouraged. When you're just a little behind on your payments, the calls from your creditor aren't frequent. Which means that although your original creditor has given up on collecting the money you owe, a new creditor now owns your debt and has the right to collect from you. If you've been laid off, and think you'll find another job in three months, assume it will take five. The result is that your outstanding balance and the payment you need to catch up gets larger every month you're late. Your creditor can take certain actions, including charge you a late fee, raise your interest rate, and report the late payment to the credit bureaus. Still, these are not always easy conversations to begin, especially if your confidence has been shaken. For example, if you don't pay your electricity bill, you face having your services disconnected. When you can't make your monthly credit card payment, the absolute worst thing you can do is just let the bill go unpaid. Usually (but not always), secured debts take precedence over unsecured debts. Some of the companies offering these services charge excessive fees, provide bad advice, don't discuss alternative ways to deal with debt, make false promises, and sometimes even take your money and run. Each month your minimum payment will get larger as more late payment fees are added to your balance. For example, federal programs may offer relief to homeowners who are struggling to keep up with mortgage payments. Usually the new creditor is a collections agency, and unfortunately, they may not be as polite in their communication with you. You also need to be aware that certain actions you take might extend or even restart the statute of limitations. Examples of unsecured debt include medical bills and credit card debt. If you don't pay an unsecured debt, the creditor must sue you and get a court judgment before it can take your wages or property to get paid. Debt negotiation firms claim that they can get creditors to agree to discount a consumer's debt, often by a substantial amount. Lynnette Khalfani Cox, author of "Zero Debt. As for how long an unpaid credit card bill might stay on your credit report, the number to keep in mind is 7 years. Thankfully, universal default has been banned. When the default rate kicks in, your finance charges will also grow. Then, decide who gets what portion of the remainder. If you find that you're consistently having trouble making your minimum payments, consider credit counseling. We are at least 10 years behind Europe in the acceptance, understanding and investment in this technology and with this legislation we will stay there. If it's no (or that no one does), ask to be transferred to the boss. After you're 90 days past due, your creditor may send you a settlement offer which would let you off the hook for the debt if you just pay a portion of your outstanding balance. Not all agencies are legitimate -- some charge excessive fees, fail to perform promised services, or provide bad advice. In general, secured obligations such as mortgages and vehicle loans receive top priority, as home and car lenders don't have to take you to court and win a lawsuit to collect what's owed.

Make copies of the letter and any paperwork, then head to the post office to send the entire package via certified mail, return receipt requested. May writing agreement letters are no big deal, free letter of agreement because they are a form of business. A debt is considered "secured" if a specific piece of property (called what happens if you can not pay your credit card bill collateral) is used to guarantee the repayment of the debt. Compare latest bank rates, interest rates, find top bank cd rates, interest. In concise paragraphs, recap your situation, the agreed-upon resolution, and a what happens if you can not pay your credit card bill statement of how you are committed to keeping the account in good standing. It is presumed he came from Lancashire, England.[5] He was active in the governance of the colony, taking part in the acquisition of Native American lands,[2] the persecution of Quakers,[6] and the apprehension and convictions of heretics.[7] His accidental death was seen by the Quakers as a punishment from God for his persecution of them,[8] an idea repeated in a play by Henry Wadsworth Longfellow. The information on this website is for use of residents of the united kingdom only. The results are contained in last year's "Fiscal Survey of the States." It notes that 27 states planned to reduce full time positions this year and 24 states said that they would be laying off employees. From there, they get moved from one collection agency to another until they are paid or discharged in bankruptcy. Grupo Logistica LaredoThis article is part of our Credit Card Debt Resource Center. The process, fostered by advanced global communications, brings lending back to its communal roots and offers lenders and borrowers a new way to deal with loans. They will generally be polite but firm, and will warn you of the consequences of non-payment. |

Seminar Series

Credit and Finance In the NewsSearch homes for rent or view home rent.com house rentals rentals at aol real estate.

We hope in the future you won’t have to wonder, “What happens if I don’t pay my credit cards.” But if you ever find yourself in a situation where you can’t pay, at least you’ll have enough information to know what you should expect. A charge-off allows the credit card company to get a tax deduction for your unpaid credit card balance. To see what the law is in your particular state, you can use this handy tool. In terms of your vulnerability to getting sued by your creditors, the statute of limitations can be anywhere from 3 to 10 years, depending on which state you live in. Six months (180 days) after you stop making your credit card payments, your account will be charged-off. Unfortunately, you cant stop calls from your credit card company the way you can with a debt collector.

When you want to stop collection agency calls, you can send a written cease and desist letter telling them you dont want to be contacted anymore.

If what you really need is money management education or budget counseling, consider getting help from a credit counseling organization. The same law doesnt apply to your original creditor. If you do want help from a credit counseling agency, check out the companys credentials first. Sometimes they’ll offer you ways of settling your debt without paying the full amount.

What if youve got nothing to offer and dont expect a recovery any time soon.

Below, we’ll attempt to describe all the possible scenarios that can result from not paying your monthly credit card bill and provide advice for how to handle these situations. More often, they will wait at least 30 days to see if you are able to pay before the next due date rolls around. Also identify the person, not just the department, to whom youll be sending your follow-up letter. By the time you are 180 days late, you are usually in a world of hurt. Many companies tout debt management plans or debt negotiation as the solution to everyones financial woes.

Smart Money Week

Learn all you can about your options for digging yourself out of debt and how to avoid scams that target people with financial woes.

The University ForumThese agencies can also suggest options for digging out of debt, provide housing counseling, and refer you to other agencies that provide specialized help. When you stop paying your credit card bills, your minimum payment will grow and your interest rate will increase. The credit bureaus maintain your credit report and compile your credit score, which lenders use to determine whether to let you borrow money – and at what interest rate. If you dont repay a secured debt, most states let the creditor take the property without having to first sue you and get a court judgment. Many creditors will extend your due date, waive the late fee, and continue reporting a current payment status to credit bureaus. Your insurance rate could also go up based on the credit card delinquencies. There’s a grey area between 30-60 days late where some companies will report and some will not. Arrange your thoughts by putting your situation and requests in writing. You must pay at least the minimum payment or make other payments arrangements to keep from being assessed a late charge or have your interest rate increased.

|

|

|