|

|

|

|

|

Valley Auto Loans, the #1 bad credit auto loan provider in the United States, is now offering auto loans in Canada. Though we can t guarantee car loans with poor credit, we make it our mission to say yes. In the past, it was very difficult for borrowers poor credit car finance with bad credit to get financing. Just fill out our simple application and our dealer/lenders will be in contact for your car finance.Apply Now. Poor credit car finance isn t limited to those guys. Is a Rent-to-Own Car a Good Option for Those with Bad Credit. Search caddo parish mobile homes and manufactured homes for sale in caddo. He enjoys selecting videos poor credit car finance and writing articles. They design and develop customized no credit auto and car financing, bad and good credit auto and car loans. Mutual fund and ETF data provided by Lipper. Meet Steve, an editor from the US who has been a member of the community for over a year now. To get a loan, simply fill the form on our website and submit it. Buyers with lower scores should save up for a bigger down payment, experts say. The loan is specifically meant for people like you and can help you take care of your financial emergency. Car finance for people with poor credit is a special kind of financing. The interest rate that you will be charged will depend on tor current income, the collateral that you provide and the amount of loan that you have applied for. Buying a rental car has a lot of benefits; these vehicles are typically less expensive, and are only between 1-2 years old. Visa Card Financial For Bad CreditNow, their services are available in Canada through their recent partnership poor credit car finance with the leading Canadian bad credit auto lending network. Getting personal loan from banks and traditional lenders has become very difficult over the past years. So let’s say you’ve thought about getting the bad credit auto loan but don’t like the interest rate you’re offered. The flip side, though, is that interest rates usually are higher for used car loans, Zabritski says. Let us help you get back on the road to financial security with a car and a poor credit car loan through the dealer/lender network at Carloans-forall.com. Any of these options could enable you to secure rates of interest that fit your budget. Valley Auto Loans makes sure that each loan is the absolute best deal for each applicant. Simply fill the form on this website and we will connect you to a number of lenders who can finance you. Many people who used to be able to walk into a dealership, pick a car, sign, and drive away find that isn t true anymore. Experts say it's not enough just to look at your credit report, which you can get for free from each of the major credit bureaus once a year at AnnualCreditReport.com. A specialty that Car Loans for all has been a part of for a long time. People with bad credit frequently find it tough to obtain a car loan with no money down. Experian Automotive found that for buyers with the lowest credit scores -- below 550 -- the average interest rate on a new vehicle loan was just below 13% and, on a used vehicle loan, just below 18%, according to Zabritski. At car loan u, we make it easy to get bad credit car finance. Finance Rims TiresPartes de carros usados en dallas en estados unidos. Toyota fj cruiser review, find pricing, inventory, incentives, dealers, photos. Anyone in need of an auto loan, but who is being held back by bad credit, should apply today with Valley Auto Loans. Experts say buyers need to take control to get the car they want at a price and interest rate they can afford. When an application is submitted, it is immediately processed, regardless of its credit score. We have decades of years in experience in helping people with poor credit obtain car loans with ease. Something else to remember is that since rent-to-own contracts typically don’t include warranties, if you don’t purchase one outside of your contract poor credit car finance and your car breaks down soon after you begin making payments (which could happen since the vehicle is likely to be older), you may not have any protection. Shop for a loan before you go to the dealer. While some prospective car buyers have turned to bad credit auto loans to get the cars they want, others have considered rent-to-own cars as an option if they are having a difficult time securing an affordable auto loan. Free Sample Letter For Putting Accounts On HoldMeet JirachiQueen, a wikiHow editor for 2 years now who loves bold editing, contributing to the Youth Project, and helping out other wikiHowians. Bad credit car finance can be seen as a second chance for people who have. Get a pre-approved car loan with bad or no credit history. We will send your information to our network of lenders, who will then contact you to for financing. Therefore, if you are considering getting a car loan with no credit history, it could be vital for you to take advantage of fast online processes. When you fill the form on the website, you are likely to receive different offers from the lenders. Of you are one of them then you need to know that nowadays obtaining a no credit auto loan could be easier than securing one with a bad credit. I recently wrote a blog post about the pros and cons of buying rental cars. Voted the best for "Quality Customer Service; Best National Auto Loans Service" by thousands of people, their finance experts focus in providing its customers information and various tools available for different auto loan offers, help them to choose the best that fits their budget as well as the related eligibility guidelines in detail.

Experts say a used car can provide a good value for a lower price, which poor credit car finance can be especially helpful for consumers with a lower credit score. Sep the collapse of the world trade center downtown nyc event space towers in had a profound impact on. Our dealers offer full service, certified technicians and many have certified used cars with extended warrantees. Besides, for finding the right type of lender for your situation, you may have to get numerous free non-binding quotes from several different loan dealers and compare them in detail by making effective use of an online auto loan calculator or some reputed comparison websites that exist online. Car dealership slogans aside, there is good news for consumers who want a new set of wheels. However, considering the inflated payments, you might find that renting-to-own is no different that obtaining a sub-prime auto loan with a high interest rate. Loan Modification ProgramBut by doing a little homework, you can avoid the disappointment of being denied approval for the advertised rates, and (eventually) drive off with a satisfying deal. The entire task could be difficult but if you seek help from some competent expert who is well versed with the exact requirements of the multiple quote comparison procedure, you may find the process lot easier. These customizable, real estate newsletters mortgage news letter help you build authentic client. Multiple lenders that specialize in bad credit review poor credit car finance each application and offer their best deals. Valley Auto Loans has been quickly changing this standard. Lenders offer different types of bad credit loans and may suggest a particular loan that is appropriate for you. Moreover, you do not have to apply for a loan from a lender that you do not want. Competitive rates and attractive terms tailored to your situation. Valley Auto Loans has quickly risen to the top of the bad credit car loan industry by providing great auto loans to anyone, regardless of their credit score or history. Economic setbacks over the last several years have ruined many people s credit rating. It is therefore important for you to get quotes from different lenders and compare them. You might not be paying interest, but the payments you make poor credit car finance will add up to a larger sum than the value of your car. If you have heard about rent-to-own cars, take time to learn more about them and whether they are something you might consider for yourself. Her favorite article on wikiHow is How to Know if a Guy Likes You. The Mortgage Crisis Was Nothing Compared to Today’s Private Student Loan Debt. At stoneacre we speite in providing bad credit car finance and don t believe. Credit Card JudgementsKnow More On No Credit Check Car Loans For Free. Carloans-forall can turn denials and rejections to acceptance. You also should get your credit score, which can be purchased from the credit bureaus or on myFICO.com. It's a good idea to have at least 20% of the purchase price as a down payment on a new car and 11% on a used car, recommends Ronald Montoya, consumer advice editor at Edmunds.com. On- time payments can boost your credit score and clean up a distressed credit report. If you have a poor credit score or no credit history, a bad credit loan is the easiest type of financing you can get. Things to Remember about Bad Credit Loans. Carloans-Forall can offer Car Loan with No Money Down.Apply Now. No credit check from those other guys means they don t belong to any of the major credit reporting agencies. Real-time quotes provided by BATS Exchange. More loans and better interest rates, however, don't mean you'll automatically get a great deal. Your payments will probably not be shown on your credit reports, so don’t count on the purchase to help build your credit. Auto loans for people with poor credit are not a sideline but one of our core services. He finds contributing to wikiHow addictive. Don’t Trust Michael Scott with Your Bank Account. Having bad credit undoubtedly makes life difficult when trying to make major purchases that require a loan. Credit approval denied, application rejected. For example, the interest rate of the loans is usually higher than that of traditional loans. How to Use Chase Bank’s ‘My New Home’ App to Get a Crazy Good Deal on Your Next House. You find a dealership that offers a rent-to-own program and visit their lot. Don t be satisfied with less, dealers who make it their business to sell cars to people regardless of their credit situation.

Provides details of the student loans system loan company which is part of the government s. If you are applying for over $2,000, lenders may need you to provide collateral for the loan. Alternatively, you could also search for a creditworthy cosigner from among your family members or friends. Check out myFICO.com's auto loan chart, which shows interest rates typically offered to consumers for each FICO score range, as well as monthly payment amounts for 36, 48 and 60-month loans at those interest rates, says Linda Sherry, director of national priorities for Consumer Action. You may get approved for no cosigner car loan finance from Carloans-Forall now. Hundreds of applicants with bad credit, good credit, no credit, even bankruptcies, have all been approved for great auto loans at Valley Auto Loans. |

Seminar Series

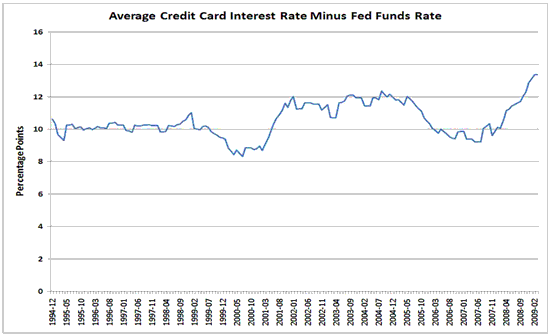

Credit and Finance In the NewsWe have a mortgage with hsbc for years.

By applying for financing from Snappy Bad Credit Loan, you are at a better position to improve your credit score and take care of your expenses. This is why Snappy Bad Credit Loans connects you directly to legitimate lenders who can finance you. A car salesman will take you around and help you pick out the car you like. There really is no cutoff score below which a buyer automatically wont be able to get financing, Zabritski says, noting that one lender might accept a score that another lender would not. The catch usually appears in small print at the bottom of the screen. Go through the offers to find one that you are comfortable with.

An option that a lot of people also overlook is purchasing a vehicle from a rental car company.

In many cases, the entire amount of your payment will be applied toward the purchase of the car, but it’s important to check with the dealer to make sure this is how they run their program. By providing you with a number of lenders to choose from, Snappy Bad Credit Loans gives you an opportunity to find the best lender in the market. However, the lower your score, the more you can expect to pay. With these loans, you have a reason to smile as you can enjoy financing just like other people with good credit.

The whole system works by way of a database of well-trusted auto lenders that specialize in Bad Credit.

Auto finance, poor credit with competitive rates and terms starts here. Nevertheless, when you have zero credit to start with, it may not be easy to obtain an approval with traditional lenders such as banks or credit unions. The seller has to make a profit somehow. Earnings estimates data provided by Zacks. However, the lenders we work with can finance you even if you have.

Smart Money Week

Get car finance from our extensive nationwide dealers network.Apply Now.

The University ForumShe considers wikiHow her second family and appreciates that everyone is always ready to lend a helping hand. Here are some major differences between leased and rent-to-own vehicles. Dow Jones & Company Terms & Conditions. Check on average interest rates for your score. Buy here/Pay here, We Tote the Note used car lots are not your only option. For over 8 years we have been one of the Internet s leading networks of dealers and lenders providing vehicles and the car loans for people with poor credit to pay for them. If after seriously weighing the pros and cons of rent-to-own vehicles you decide this is the best option, it’s good to investigate the dealership you want to work with to ensure it is a legitimate business. What an Auto Loan on Each of the Cars of Fast and Furious 6 Will Cost You Auto Loan Deal of the Day. A credit analysis recently released by Experian Automotive, however, found that more buyers with poor scores are getting approved, and adding their lower scores to the mix has brought average scores down almost to pre-recession levels.

|

|

|